Clegg argues that AI can help battle misinformation and disinformation too, "whether it's created by a human being or by a machine. Investors wiped 80bn (£69bn) off the market value of Facebook and Instagram’s owner, Meta, after Mark Zuckerberg’s company reported profits had. One of the big concerns about AI is how it can be used to create misinformation or disinformation that could impact an election. Get the latest Meta Platforms Inc (META) real-time quote, historical performance, charts, and other financial information to help you make more informed. After the meeting concluded, Meta's President of Global Affairs Nick Clegg told Yahoo Finance Live's Seana Smith and Allie Garfinkle that he believes all the tech companies at the meeting want to move AI technology forward quickly, but responsibly, adding that Meta is "absolutely determined to follow-up and honor these commitments." Clegg doesn't share the fears that some have of AI, saying that some of predictions "have slightly run ahead of the technology." Clegg does say concerns about things like deep fakes and the manipulation of audio and video are "legitimate," but that "the technology which generates that unwelcome material is also the technology we will use to actually identify and control it." On regulation, Clegg said it is "definitely" needed, but that companies are not "going to sit around an wait for legislation," noting that's part of the reason why these voluntary commitments are being made.

The companies agreed to voluntary safeguards to better manage the risks posed by AI. Representatives from tech giants including Meta (META), Amazon (AMZN), Microsoft (MSFT), and Alphabet (GOOGL) met at the White House to discuss regulating artificial intelligence.

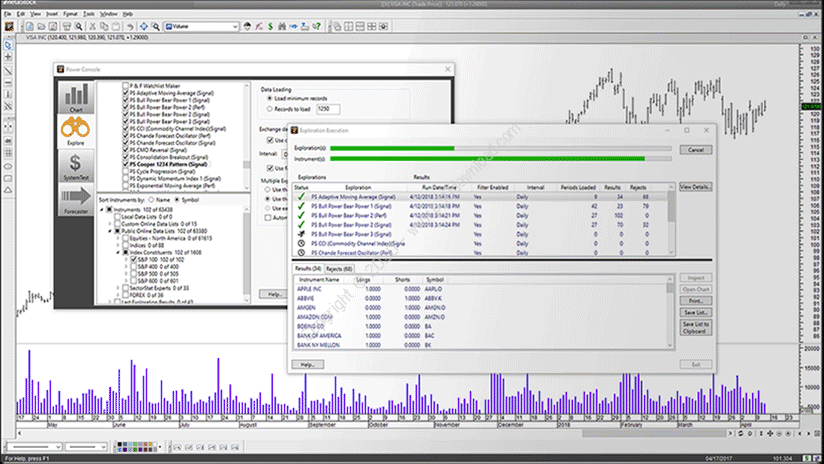

META STOCK SERIES

The continued revenue decline marks the latest in a series of challenges for Meta this year, including the announcement in June that Chief Operating Officer Sheryl Sandberg would depart the company as well as difficulty yielding revenue from its multi-billion-dollar investment in its metaverse project.Yahoo Finance Video Meta Exec Nick Clegg talks White House AI meeting, regulation The company’s stock price has fallen roughly 60% in 2022, more than double the decline experienced by the tech-heavy NASDAQ. But that isn’t enough for Mark Zuckerberg, columnist Lauren Silva Laughlin writes. That figure comprises 4% year-over-year growth, which matches the rise in daily users reported over the prior quarter. Since Twitter went off the public market, the equity value of Meta Platforms has soared. Meanwhile, the company reported 2.93 billion daily active users on its family of apps, which includes Facebook, Instagram, WhatsApp and Messenger. Shares of Meta were down more than 10% in after-hours trading immediately after the announcement. That slump exceeded the 1% year-over-year decline during the previous quarter. That makes it the cheapest FAANG stock by a wide margin. Revenue declined 4% year-over-year, the earnings report showed. The bulls believe Metas stock is a screaming bargain at 12 times forward earnings.

Thursday’s drop shaved more than 230 billion from its market cap, bringing it to about 660.

META STOCK UPDATE

In addition, an Apple iOS privacy update last year, which limits the capability of advertisers to target users, has continued to weigh on ad sales at the heart of Meta’s business. The stock finished with its biggest one-day drop ever, ahead of the 19 plummet it saw in July 2018. Meta, the parent company of Facebook, reported a second consecutive quarter of declining sales on Wednesday, as the company contends with a widespread drop in online ad spending and rising competition from TikTok.

0 kommentar(er)

0 kommentar(er)